Picture this: you've just found the perfect item online, and you're ready to make the purchase. You enter your credit card information, click "buy," and wait for your new treasure to arrive. But what if you put your credit card information in the wrong hands? This sensitive financial data can lead to unauthorized charges and a whole lot of stress. That's where Google's virtual card feature comes in – it's digital shield for your credit card number, keeping it safe when you shop online using Chrome or make in-app purchases and Tap to Pay on Android devices.

Virtual cards are unique, randomly generated card numbers that are linked to your actual credit card account, but they keep your physical card number hidden from merchants. When you use a virtual card for an online transaction, the merchant only sees the virtual card number, while your real credit card information stays secure in the background. It's like having an extra layer of protection – even if a website or app you use is compromised, your physical credit card details remain safe.

Read more: FCC Forces ISPs to Be Honest with Consumers

Google has partnered with American Express, Capital One, and, just recently, Citi to offer virtual cards. Each company has its own way of providing extra security. Some credit card companies will assign a different security code (also known as the CVC) to each online merchant. This means that if you use your virtual card to make a purchase on two different websites, each site will have a unique security code associated with it. Other companies will change the virtual card number itself for each merchant.

Regardless of which method your credit card company uses, the end result is the same – your virtual card will only work on the site it was meant for. That means that if someone manages to get hold of your virtual card number from one website, they won't be able to use it anywhere else. Also, if you get tricked into using a card on a malicious site, only your virtual card needs to be deactivated.

Read more: Understanding Chrome's Incognito Mode: What It Does & Doesn't Protect

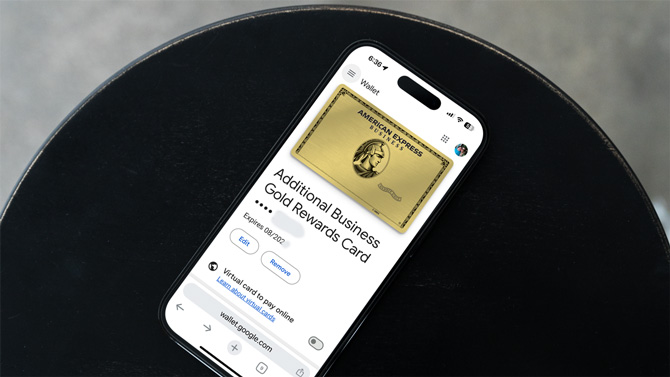

Using virtual cards is simple once you have it set up. You'll need to go the Google Wallet site (for iOS) or open Google Wallet (for Android), add your credit card information, and turn on virtual card. For Android users, you'll need to activate Tap to Pay for your virtual card. For Chrome, you'll need to open Settings > Passwords and Autofill > Payment methods and turn on "Save and fill payment methods."

When you're ready to check out, Google will automatically fill in the virtual card information for you if you select Google Pay. As an added security measure, your credit card company might ask you to verify your identity before completing the transaction by providing a temporary code they send to your phone. If, for some reason, the autofill doesn't work, you can still view your virtual card information in your Google Wallet and enter it manually.

The next time you're ready to make a purchase online, consider using a virtual card. It's a simple yet effective way to keep your credit card safe while enjoying the convenience of online shopping or Tap to Pay.

[Image credit: Screenshot via Techlicious, phone mockup via Canva]

For the past 20+ years, Techlicious founder Suzanne Kantra has been exploring and writing about the world’s most exciting and important science and technology issues. Prior to Techlicious, Suzanne was the Technology Editor for Martha Stewart Living Omnimedia and the Senior Technology Editor for Popular Science. Suzanne has been featured on CNN, CBS, and NBC.