We may earn commissions when you buy from links on our site. Why you can trust us.

The Best Tax Software

No one enjoys filing income taxes, and many of us tend to wait until the last minute to do so. But don't, advises personal finance expert Ellen Rogin, CPA, CPFR. Working on your taxes right before they're due only makes the experience a lot more stressful, especially if you find out you need additional documents or files to get things right.

No one enjoys filing income taxes, and many of us tend to wait until the last minute to do so. But don't, advises personal finance expert Ellen Rogin, CPA, CPFR. Working on your taxes right before they're due only makes the experience a lot more stressful, especially if you find out you need additional documents or files to get things right.

Fortunately, it's easy to get your taxes done at home with solid tax preparation software backed by accounting professionals who will walk you through the entire process. We'll take a look at the software that can make this year's taxes a breeze — or, if not a breeze, at least as easy and straightforward as taxes can be. Best of all, they'll all let you file a basic federal return for free if your tax needs are simple. You might not even have to spend a dime!

The best tax software: TurboTax

You've heard of TurboTax, and with good reason. Software maker Intuit has been in the tax business since 1993, so it's safe to say it has a lot of experience helping consumers getting their taxes done.

You've heard of TurboTax, and with good reason. Software maker Intuit has been in the tax business since 1993, so it's safe to say it has a lot of experience helping consumers getting their taxes done.

TurboTax 2014 is a good option for tax filing no matter what your needs because there's a version of the software suited for everything, from the simplest return to the most complex. The software walks you through questions and fills out the forms for you, double-checking calculations and suggesting possible deductions. If you've used TurboTax in the past, the software makes it a snap to get started by importing last year's tax information.

Versions You can use TurboTax Online from any computer with Internet access, buy a download online or buy a boxed version from a retailer. Intuit also offers SnapTax for your smartphone and TurboTax for the iPad, both which let you do simple returns on the go.

Guarantees 100% accurate calculations and the biggest refund.

Support options Phone, live chat or online forums.

What if I get audited? All TurboTax software offers free Audit Support, including one-on-one guidance from a tax professional, answers to audit questions and advice on how to prepare. But you can also purchase Audit Defense, which provides you with full-service audit representation from a tax professional — so if you get audited, you won't have to deal with the IRS at all.

Cost From free for the online TurboTax Free Edition to $149.99 for the full-fledged TurboTax Business. We suspect most users will be happy with the online TurboTax Deluxe for $29.99 (plus $36.99 if you need to file a state return — though if you do need to file a state return, you'll save by picking up a boxed version of Deluxe for $59.99, which includes free state filing).

Best for those who want to deal with a real person: H&R Block

Most users will find H&R Block's software to be very much like TurboTax. The big difference here is that H&R Block has local offices where you can get in-person help or have your return reviewed — a great option if you like the extra assurance of having an accountant review your work. H&R Block's Best of Both service lets you do your own taxes using its H&R Block Premium software and then sends it to a tax professional to review your return, make corrections and be sure you haven't missed any tax breaks.

Most users will find H&R Block's software to be very much like TurboTax. The big difference here is that H&R Block has local offices where you can get in-person help or have your return reviewed — a great option if you like the extra assurance of having an accountant review your work. H&R Block's Best of Both service lets you do your own taxes using its H&R Block Premium software and then sends it to a tax professional to review your return, make corrections and be sure you haven't missed any tax breaks.

With Block Live, you don't even have to go that far. Block Live lets you send your tax documents to a tax professional who will work with you over the phone, by video chat or by text chat. Of course, if you want to just do your taxes yourself, that's an option, too.

Versions H&R Block offers online software you can use from any computer with an Internet connection, as well as downloadable software. You can file simple returns from your iPhone or iPad with the free 1040EZ Tax App or H&R Block Tax Preparation app.

Guarantees 100% accurate calculations and the biggest refund.

Support options In-office, phone, live chat or online support site.

What if I get audited? H&R Block offers Worry-free Audit support free with H&R Block software. This means H&R Block will help you sort through correspondence with the IRS and prepare for an audit and then represent you.

Cost From free for the H&R Block Free online edition to $79.95 for H&R Block Premium & Business. For all programs, expect an extra fee for state filing ranging from $19.95 to $36.99; if you need to file a state return, be sure to pick a package with state returns included, or you'll wind up paying extra for state software.

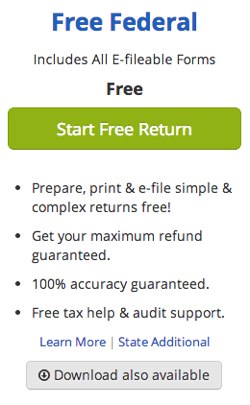

The best value: TaxACT

TaxACT keeps things simple, both in software and in price. You can expect the program to walk you through your taxes just like TurboTax or H&R Block, with the same accuracy and refund guarantees but with fewer support options. TaxACT costs a lot less than the alternatives, making it a great value if you don't need extra help.

TaxACT keeps things simple, both in software and in price. You can expect the program to walk you through your taxes just like TurboTax or H&R Block, with the same accuracy and refund guarantees but with fewer support options. TaxACT costs a lot less than the alternatives, making it a great value if you don't need extra help.

Versions TaxACT has online software that you can use from any computer with an Internet connection, as well as downloadable software.

Guarantees 100% accurate calculations and the biggest refund.

Support options You get phone support with the paid version of TaxACT, while free and paid users have access to the online support site.

What if I get audited? TaxACT's online Audit Assistant will guide you through an audit.

Cost From free for TaxACT Free Federal to $59.99 for TaxACT Home and Business. Most users will probably want the TaxACT Ultimate Bundle, which includes both federal and state filing for only $17.95.

How can I get ready for next year?

If you owe taxes this year or you're due a refund, Rogin recommends adjusting the amount you're having withheld from your paycheck. Though you may use withholding as a way of forcing yourself to save, you'd be better off putting that money into a savings account — or, even better, a 401k or IRA. Either way, withholding the right amount will make tax time next year less stressful.

But the biggest thing you can do to get ready for next tax season is to get organized well before April 2015. "Clear the clutter," Rogin says. "We all know that you should have systems for organizing your financial life, but most people don't."

Getting organized doesn't have to be complicated, either. Rogin says that even something as simple as keeping your records for the year in envelopes — be sure you know where they are and label them clearly — will be a big help come tax time. If you want to get more elaborate, you can always start keeping your records in a bookkeeping program or saving bills and receipts in Evernote.

"Losing paperwork can cost you money," explains Rogin. But organization can save you money when you know where to find important tax and other financial papers when you need them —plus you'll enjoy the bonus of less tax-time stress, something we'd all like this time of year.

[woman with calculator and computer via Shutterstock]

From Alexander Innes on February 20, 2014 :: 6:47 pm

Alot of people like us, file 1120S along with a 1040 and taxact seems to be the only one offering this.

What’s up here?

Reply